When a company like Cerebras goes for IPO, it is not just about listing on stock market, but it is about sending a signal to the world that “we are ready for next level.” Cerebras is already well known in AI circles for building the world’s biggest AI chip, and now the IPO is expected to bring it into limelight of mainstream finance. Many investors are curious about what this means in terms of valuation, share price, date and long-term returns. But it is also important to understand the risk and how this IPO is different from others in tech. In this full guide we will go through the IPO details, what makes Cerebras special, who is backing them, and what you should watch out for before thinking to invest.

What is Cerebras and Why People Care?

Cerebras was founded in 2016 in Silicon Valley, and from the beginning it was aiming for something that no one else had done – build a single giant chip on a wafer instead of multiple smaller GPUs. This chip, called Wafer Scale Engine (WSE), is not only the biggest semiconductor ever built but also one of the most powerful for deep learning. Where Nvidia GPUs are considered standard, Cerebras is trying to become the “next big leap” in AI hardware.

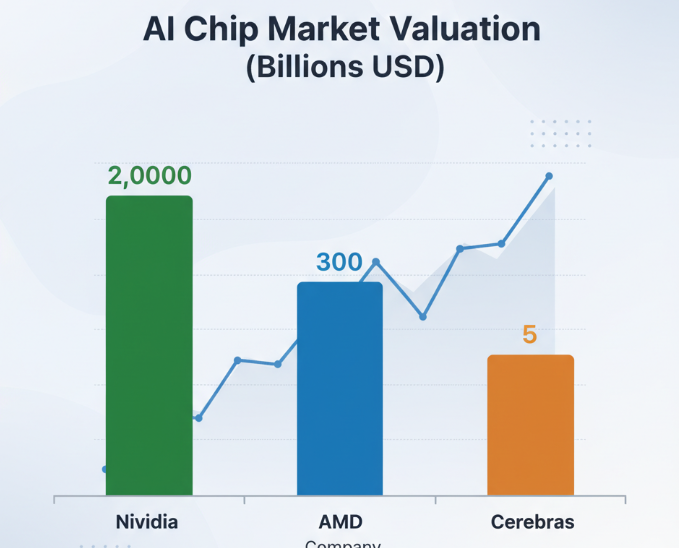

Why does this matter? Because right now AI is booming everywhere. ChatGPT, MidJourney, medical AI, military AI – all need massive computing power. Traditional GPUs are powerful but limited in scaling, so companies are searching for new solutions. Cerebras offers that, and it is already working with government labs, defense contractors, and biotech firms. This is why its IPO is being compared by some analysts to early Nvidia or even Tesla moment.

If you want to follow more such news on AI startups, funding rounds, and IPOs, check out our Tech News section.

When Could the IPO Happen?

As of now the exact date is not confirmed, but multiple reports from Bloomberg and Reuters suggest Cerebras has already partnered with investment banks to file its paperwork. This usually means IPO is only months away. Most likely, it could happen in late 2024 or early 2025 depending on market conditions.

Timing is everything in IPO. If markets are strong and AI hype continues, they will push it sooner. But if markets are shaky, the IPO can be delayed. This is the same strategy we saw with Arm IPO in 2023 and Reddit IPO in 2024. So investors need to watch official SEC filings and news updates closely.

You can also track updates from reliable sites like Bloomberg and TechCrunch, which cover IPO market in detail.

IPO Price Range – What Can Investors Expect?

One of the hottest debates around Cerebras IPO is its share price. While nothing is official, experts expect the IPO price to be somewhere around $25 to $40 per share. That would depend on how much demand investors show during book building.

If there is huge demand like we saw with Snowflake IPO in 2020, the price could be at the higher end or even more. But if investors become cautious because of tech stock volatility, it could be priced conservatively. The goal is to raise around $500M – $1B, which would give Cerebras enough funds to scale production and compete with Nvidia and AMD.

Cerebras Valuation Story

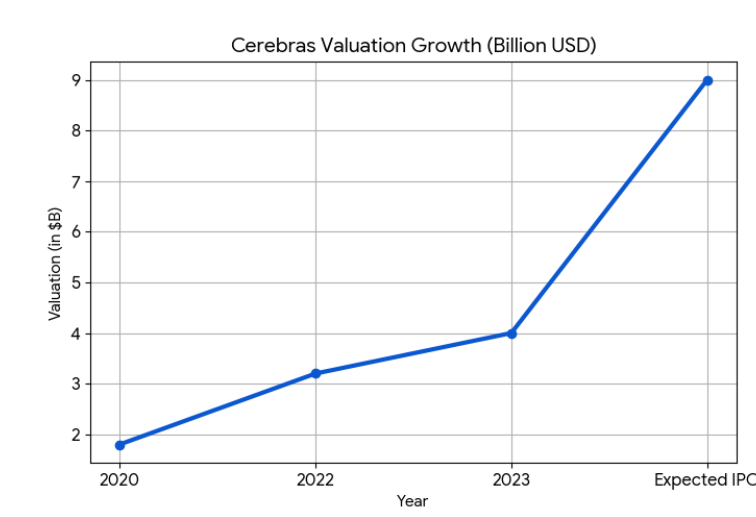

In its last private funding round, Cerebras was valued close to $4 billion. But since then the AI industry exploded in 2023 and 2024, with Nvidia stock going up by over 200% in a year. Because of this hype, experts believe Cerebras valuation at IPO could jump to $8 – $10 billion, maybe more if institutions fight for shares.

Here’s a quick graph showing how Cerebras valuation could grow compared to its past funding:

Who is Backing Cerebras?

Cerebras is not going to IPO alone. It already has support of top investors such as:

- Benchmark Capital – One of Silicon Valley’s oldest and strongest venture firms.

- Coatue Management – A global hedge fund betting big on AI.

- Altimeter Capital – Known for IPO plays like Snowflake.

- Moore Strategic Ventures – Run by billionaire Louis Bacon.

These names bring not just money but also experience in taking companies public. For small investors, knowing such heavyweights are backing the IPO is often a green signal.

Why Investors Are Excited

The hype around Cerebras IPO is huge because it combines two things investors love – AI and semiconductors. AI is expected to grow into a $400+ billion market by 2030, and semiconductors are at the heart of it. While Nvidia is currently the king, many investors feel there is space for new challengers.

Also, Cerebras is one of the few companies with a completely new approach to chips, which makes it stand out from dozens of AI startups. For those who missed Nvidia early, Cerebras looks like a “second chance” story.

Risks and Red Flags to Consider

But investors should not just see the shiny side. Cerebras faces serious risks:

- High competition from Nvidia, AMD, Intel, and even startups like Graphcore.

- Manufacturing risk because wafer-scale chips are expensive and difficult to produce.

- Profitability issue since Cerebras is still losing money.

- IPO market volatility that can crush price if global stocks go down.

This is why even though analysts are positive, they still warn investors not to put all money into one bet.

Table: Cerebras IPO at a Glance

| Factor | Details (Expected) |

| IPO Date | Late 2024 / Early 2025 |

| IPO Price Range | $25 – $40 per share |

| Expected Valuation | $8 – $10 billion |

| Funds to Be Raised | $500M – $1B |

| Major Investors | Benchmark, Coatue, Altimeter, Moore Strategic |

Final Thoughts

The Cerebras IPO could be one of the most interesting events in the AI world. It brings together cutting-edge chip technology, massive investor interest, and perfect timing in the AI boom. However, just like all IPOs, there is both risk and reward. If AI keeps growing and Cerebras proves its technology at scale, this IPO might become a golden opportunity for early investors. But if production issues or competition slow it down, the stock might struggle after listing.

For readers who want more updates on IPOs and upcoming tech company news, check out our Tech News category. And for financial depth, sites like Reuters and Bloomberg are must-follow sources.